Financial goals are the foundation of a sound financial plan, providing a roadmap for individuals to navigate their financial journey. Whether you are aiming to buy a home, fund your children’s education, retire comfortably, or achieve any other financial milestone, setting clear and achievable goals is crucial.

Setting financial goals involves identifying your priorities, understanding your current financial situation, and outlining the steps needed to reach your desired outcomes. It is a proactive and intentional approach to managing your finances, allowing you to make informed decisions that align with your aspirations. Don’t know where to begin? Think SMART! Setting SMART goals is a fantastic way to put your thoughts onto paper and begin the process of achieving a financial goal. Most recently, I have set a challenging financial goal of graduating from K-State debt-free.

Here is how my goal looks from the SMART perspective:

Specific: I have this goal concisely down into one specific item. Having too broad of goals can make it difficult to stay motivated to obtain them.

Measurable: Being debt-free is fairly cut and dry in how I will be able to know this. Do I have any student loans, repayments to parents, any other loans with a bank, etc.

Achievable: While this will not be an easy task, I strongly feel some of the practices I have developed and am using will make this possible.

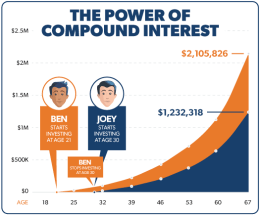

Relevant: To me, this goal is truly relevant. To be able to graduate debt-free and not worry about repayment would be a huge financial success. From my very first paycheck, the money that would have to go to pay the loans can immediately be invested. Being able to start investing in accounts that have compound interest even a year sooner can potentially allow me to retire sooner or save money for my first house down payment.

Time-Bound: By including “when I graduate,” I have put a timeline on my goal, and I will know whether I have achieved it.

Calculating Total Costs/ Utilizing Scholarship Opportunities:

The first step I took in this financial goal was to calculate what my total costs would be factoring in tuition, housing, and monthly expenses throughout my 4 years using Powercat Financials’ Education Financial Plan. This tool then allowed me to insert scholarships and expected work income over the next 4 years, further allowing me to see if this goal is achievable. After completing this spreadsheet, I knew I had work to do. The first thing I thought of was scholarship opportunities. Scholarships are an incredible way of being rewarded for being involved and the leadership roles you held. Think about it this way… if you won a $1000 scholarship that took 2 hours to complete, you made $500 per hour! Comparing that to an average college salary of $14 per hour, it would take 71 hours to make $1000. I believe that utilizing scholarship opportunities is the MOST important way to help pay for school. How to prepare for this? Always update your resume, have strong record-keeping skills to remember all that you did so you can build the strongest application you can, and keep up with schoolwork by having a good GPA for your degree path.

Managing Work and Studies:

As mentioned in the Education Financial Plan, working while attending school is a great way to get some cash inflow to help pay for school and additional expenses. While at K-State so far, I have worked 4 part-time jobs at various points in my college career. Currently, I work for a swine farm and Powercat Financial. I’ve also served two terms as the Alpha Gamma Rho Fraternity Recruitment chair and was a teaching assistant for an Ag Economics class at KSU. While these jobs have kept my college life very busy, it has given me some financial freedom to spend some money on hobbies, build savings, begin small investments, and of course, help me achieve my goal of graduating debt-free.

How I have enough time in the day to have a job:

For me, taking a class each summer and winter intersession has allowed me to only take 12 hours each semester while at K-State. This works to my advantage in a couple of ways. First, you can often find these classes at a cheaper rate than the fall/spring semesters. This has allowed me to save money on my coursework and utilize cash in other places. Second, only having 4 classes has given me more free time to work. Lastly, only having 4 classes without a doubt has helped my GPA which ties back into scholarship opportunities. Plus, having more time to focus on my classes has allowed me to retain more info from those classes, giving you more bang for your buck!

How I manage the money I earn:

Another important component to spending habits on things that don’t bring much in return. A good example of this is food. While it is fun to go out and eat nice once in a while or conveniently go grab a burger from your favorite fast-food restaurant, food is an expense that can add up quickly. Another example is coffee. Spending $5 on a coffee each work morning is $1250 per year (using 250 workdays). These are expenses I try and eliminate as much as possible. Saving money in places such as food and coffee can allow you to build up some savings. Currently, there are numerous ways to earn a risk-free 5% return on your savings. I have taken full advantage of this opportunity over the past 2 years as prior risk-free rates were less than .5%.

Even with all these practices I use to make financially sound decisions, it’s still important to allocate funds to enjoy yourself. I like to live by 2 mottos, work hard play hard and life is only as fun as you make it. While in college, this could be the only time of your life to go on various trips and have 20,000 + peers to network with and build connections. For me, my “play hard” has been traveling to KSU Football and basketball games. In my 1.5 years at K-State, I’ve traveled to Ames, Fort Worth, Arlington, Columbia, and Lawrence to support the football team. For basketball, I have attended both “Cats in KC” games, and both games played in Allen Field House. Utilizing sound financial practice has helped me get on a path to achieving my goal of graduating debt-free while still enjoying my college experience.

James DeRouchey

Peer Counselor I

Powercat Financial

www.k-state.edu/powercatfinancial