What is a credit card?

A credit card represents a line of credit (money available for borrowing) that allows the card holder to borrow funds quickly. Think of swiping your credit card like taking out a mini loan for whatever you are buying. Similar to loans, you are expected to pay back the amount you borrow. This amount normally comes due at the end of the month. If you miss your monthly payment or carry a balance forward into the next month (owe money on the card), the company you are borrowing from will charge you the predetermined interest rate. The average interest rate on credit cards currently is 21.68%. When you are issued your credit card you will notice that there is a credit limit, this is the maximum amount you can borrow on your card. Overtime, this limit can be increased if you are managing your card well.

Differences between Credit Cards and Debit Cards

| Credit Cards |

Debit Cards |

|

|

Managing your credit card:

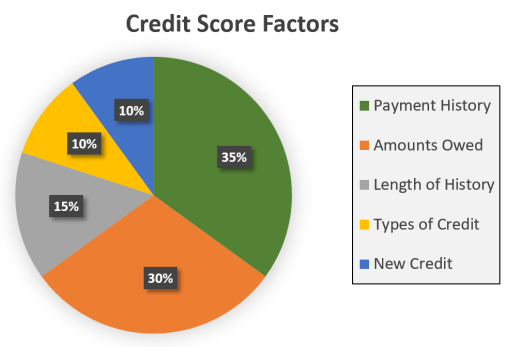

Credit cards can be a big responsibility due to the potential for them to be mismanaged. If you are not careful you can rack up a lot of debt and fees that you might not be able to pay off. Additionally, if you miss payments or misuse your card it can hurt your credit score. Your credit score is like your financial GPA and is calculated based on five different things.

- Payment History: 35% of your credit score is based on if you make your payments or not. Be careful not to miss payments!

- Amounts Owed: 30% of your credit score is determined on your usage of the credit made available to you.

- Length of History: 15% is determined by how long you have had credit; the longer the better.

- Types of Credit: 10% is effected by how many different types of credit you have. It is actually good to have several types of credit (i.e. a mortgage, student loans, and a credit card).

- New Credit: 10% is based on how often you apply for credit.

Finally, to check your credit report, you can go to this website for a free credit report three times a year (due to the pandemic, you are currently able to check your report weekly): Annualcreditreport.com. Your credit report is like your financial GPA, it includes information about your credit accounts, account payment history, and credit limits. It is important to check your report frequently to catch identity theft. Any credit usage under your name and social security number will appear on the report. If there is activity that you know isn’t you then sound the alarm! (Identity Theft Information). Your report will also show your credit score which is like your credit worthiness. Credit scores can range from 850 to 300. The higher your score the better with 700 or higher considered excellent. Having a good credit score is important because if you have a low credit score you could pay higher interest, have a lower credit limit, and it can even impact your employment or renting opportunities.

Three Helpful Tips:

To maximize your credit card for your benefit, I recommend keeping these tips in mind:

- Pay off your credit card every month so that there is a zero balance at the end of every month.

- Only use 30% of your credit limit. For example, if your credit limit is $2,000 you should keep spending to a maximum of $2,000 x .30 = $600. This means that you should try to keep your credit card spending under $600 for a month.

- Shopping and applying for credit cards can decrease your credit. Make sure you only apply for one credit card at a time!

Helpful Links:

If you have any questions about credit cards or want to learn more, please feel free to schedule an appointment with us at Powercat Financial. All appointments can be made on our website: Powercat Financial.

Abram Mugler

Peer Counselor II

Powercat Financial

www.k-state.edu/powercatfinancial