Graduation is right around the corner!

Whether you are a freshman just beginning your academic career at K-State or a senior finishing up those last classes before May, thinking about starting your career, moving to the city of your dreams, or all the people you can meet while out in the world can be thrilling. However, have you thought about the details of what your future might look like? How your expenses may change with college life behind you? How your earnings could change with your new degree, or what your budget might look like after graduation? Planning ahead and answering these questions can be crucial when jumping into the world outside of college. This blog post covers some of these concerns and provides resources for further exploration.

Step 1: determine a realistic starting salary

Before graduating from college and entering the workforce, students apply for all of the jobs that align with their passions in cities or towns that they feel comfortable with living in. One aspect that some students struggle with is knowing what might be a realistic salary for a starting position in their field. A 2022 survey found that most students over-estimate their starting salary by tens of thousands of dollars. This can result in disorientation and stress from that over-estimation.

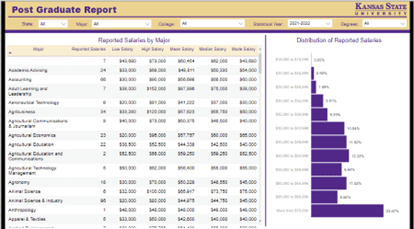

In order to avoid this, you need to set a realistic sense of your future entry-level salary and the cost of living. There’s good news though! There are tools to help. One of the tools available is the Career Center’s Post-Graduation Statistics, which includes a salary dashboard. This dashboard provides basic statistics collected on entry-level salaries organized by major.

When you use this tool, pay attention to how many reported salaries were used to create the averages. Some majors have very few submissions which can skew the data. If you look up your major and you find it has 20 or less, look for additional salary info through an alternate resource. Want to make sure this tool is accurate for future K-Staters? Report Your Job on the K-State Career Center website!

Other resources you can use to determine possible salary include careeronestop.org, myplan.com, salary.com, or the salary calculator found through jobsearchintelligence.com, which allows you to filter by location and years of experience.

Step 2: calculate the cost of your living expectations

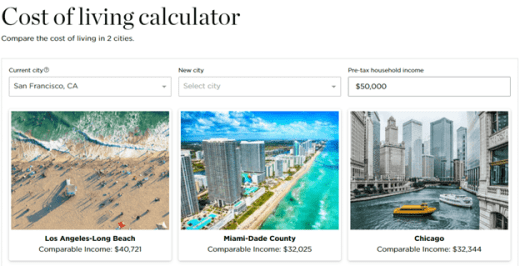

Great job taking the first step for your future financial well-being! The second step that you need to take to prepare for the creation of a post-graduation budget is to figure out where you may want to live in the future and research the cost of living in that area. With this cost-of-living calculator from NerdWallet you are able to take where you currently live and contrast it with where you would like to live in the future.

This calculator will help you be more mindful with your budget. A salary of $100,000 could get you far here in Manhattan, Kansas but maybe not so far in New York City, where costs are much higher. Being able to note this difference is the crucial second step in setting a realistic expectation for your future self and setting yourself up for that healthy post-graduation budget.

Step 3: Create a post-graduation budget

Graduation and life after college can cause dynamic shifts in life. Whether it be moving to an entirely new city or having to get used to a whole new schedule, the transition from college life to work life can be huge! The last and final step of prioritizing your future financial well-being and planning for post-graduation is to anticipate likely changes and create of your post-graduation budget.

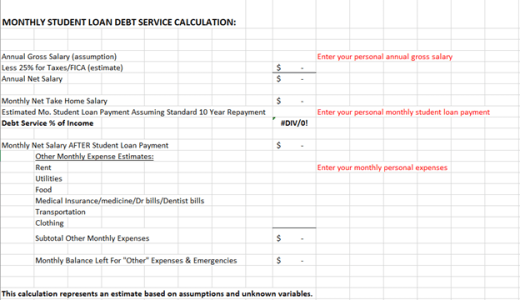

Another tool provided by Powercat Financial that is helpful with this goal is our Monthly Student Loan Debt Service Calculation sheet. It’s a short sheet that’s easy to fill out and covers the basic expenses such as rent, student loan repayment, and food. Input the salary you’ve been offered or the average starting salary you determined in step one. Then fill in realistic expenses for what you would think your future might look like. Start with familiar expenses like rent and food, then add in things you may never have covered before.

One tricky thing to add is the current expenses that have been covered by a parent or guardian that you may take on when you graduate. Some of these expenses could include streaming services like Netflix, cleaning supplies for the apartment, car insurance, and health benefits. It’s best to brainstorm all of the potential expenses you might have that aren’t a part of the sheet above and add them. Do you want to get a pet? Will you need to travel home for holidays? Lots of your expenses may change. The more detail included in the budget the better!

Step 4: Enjoy life and adjust plans as necessary

Once you have completed step 3, you’ve set a foundation for your future financial well-being. The neat thing is, after you have graduated and can determine real numbers for these expenses, you’ll be able to update the spreadsheet, and your budget will adjust automatically. As more of these real numbers get added, the more attuned your budget will become to your life. Overall managing your expectations and creating a post-graduation budget can not only make life easier, but it can also help avoid lots of needless stress by helping you plan ahead!

Need help mapping your future budget?

If you would like to have some guidance or a peer to help as you draft your budget, Powercat Financial is here for you! We are a free service where your fellow students help with whatever financial questions you may have. Whether it be budgeting or maybe helping you calculate the amount of student loans you need, we would love to help. Our goal is to facilitate the financial well-being of each and every Kansas State University student. Schedule with us today through Navigate!

Jackson Harvey

Peer Counselor I

Powercat Financial

www.k-state.edu/powercatfinancial