School’s out, the weather is nice, the pools are open…its must be summertime. The summer is a great time to get outdoors, try something new, go on vacation. There’s is so much you can do, but with extra summer fun, come extra summer expenses, and although we might wish we had money to do everything, that sadly is often not the case. However, if planned for effectively, summer can be a time where you save and smartly manage money on a budget while having all the fun in the world. Let’s review how to budget this summer and brainstorm some fun but smart money saving activities.

Set Goals

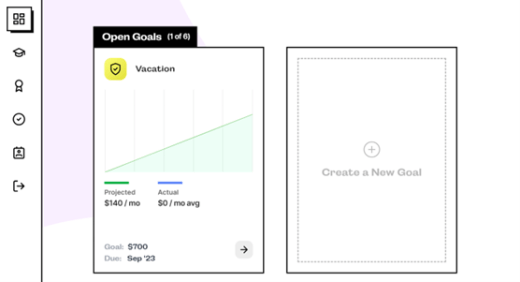

The first step with any budget should be to determine, “why am I making a budget?” Am I making a budget to save money? If so, what am I saving for? These are important questions to ask ourselves to find our motivation for making a budget. If we don’t have proper motivation or goals, it will be hard to make consistent smart money managing choices toward saving. One goal could be that you want to save money so you can go on a vacation, or buy a certain item, or maybe you just want to save $1,000 by the end of the summer. All of these are good goals to make, the important thing to remember is that your goals should SMART – Specific, Measurable, Attainable, Relevant, and have a set Time-frame.

Specific – Make sure your goals aren’t vague are distant. You define a clear goal or action that you want to save for. For example, “I want to save for a new laptop for school next year. The one I want is $600.”

Measurable – Something you can build to. This would mean not just saying, “I want some money for a vacation”, but instead saying, “I want to save $700 over the next 3 months, to save for my vacation in 4 months.” The second statement has a set dollar amount and timeframe which we’ll get to in a minute.

Attainable – Your goal should be something that can be realistically achieved through the means you have at your disposal. Don’t commit to try and save $5000 in a year when you only make $200 a month. That’s not attainable. Instead, you could try and save maybe $1,000 in a year.

Relevant – Have your goal be applicable to you and something you can save for. This may be dependent on what some of the other factors are or what your priorities are. If you have $10,000 plus in student loans but still have 2 years of school left and feel like you’re drowning in school, a $100 weekend mental health trip might be more relevant then giving that money towards your loans.

Time-frame – Be specific in how long you want to save or budget for. Based on the saving statements made in the measurable definition, save for a specific set of time. This helps you keep on pace in your budgeting process.

Make Your Budget

Now that you’ve come up with your smart goal, your summer budget can be made! This can be hard to do sometimes though. The good news is, at Powercat Financial, we have some great tools to help. Check out our budget spreadsheet, which provides a detailed list of possible expenses so you don’t miss anything when creating your personalized budget. You can make an appointment with us at Powercat Financial, and we would love to help walk through this with you.

Another helpful goal setting resources is levylup.com. You can create an account and start making goals to save for—it’s under development, so you can provide feedback to help it become a tool that truly fits your needs.

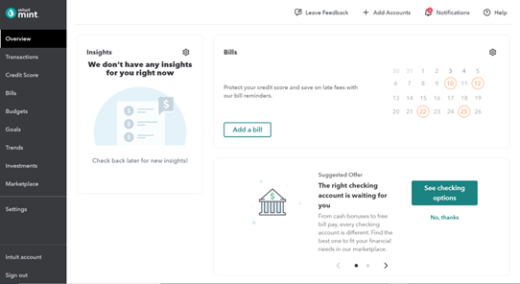

Another well-established resource is mint.com. Mint offers a budget framework to help you stay locked in on your budget and easily keep track of your expenses.

Summer Activities on a Budget

We’ve set a goal and made a budget, but does that mean that we just sit inside all summer twiddling our thumbs until we’ve saved for our goal? NO! There’s all sorts of fun activities and things to do without breaking the budget. Here’s a few different activities:

- Go Outside – This sounds simple and obvious, but it’s true! Going outside is free and can be very relaxing and fun, especially with friends.

- Play Disc Golf – Disc golf is an outside sport that is usually free to play. There are disc golf courses all over the place that combine skill, games, and the outdoors for a fun experience!

- Go To a Cheap Movie – Some movie theatres will have cheap and sometimes even free movies over the summer. This is a great way to have some fun with friends or by yourself this summer!

- Get a Library Card – The summer can be a great time to finally catch up on some books from your library that are on your reading list. You could take a good book and go read in the park or just in the comfort of your own home. Reading a book is a portable but fun and productive endeavor.

- Go Hammocking – Hammocking is an awesome way to enjoy the weather outside will relaxing and being in the shade. It isn’t hard to do and all you need is a hammock and two close-together trees.

- Go Geocaching – Geocaching is a way you can go on an adventure for free. There’s plenty of Geocaching spots around town that might have some kind of prize or treasure just waiting to be discovered.

- Play a Board Game – Board Games can be fun to do with anyone and take very little financial investment. Take it to a park and play, or just play at home, either way board games are a blast.

Get Help at Powercat Financial

Whatever you plan or do this summer, remember to make a budget, and stick to it! This will be key to achieving goals for summer and beyond! If you need any help in determining your goals or have any questions about making a budget, make a free appointment with us at Powercat Financial. We offer free confidential appointments either via Zoom, or in person. Have a great summer!

Daniel Hensarling

Peer Counselor I

Powercat Financial

https://www.k-state.edu/powercatfinancial/