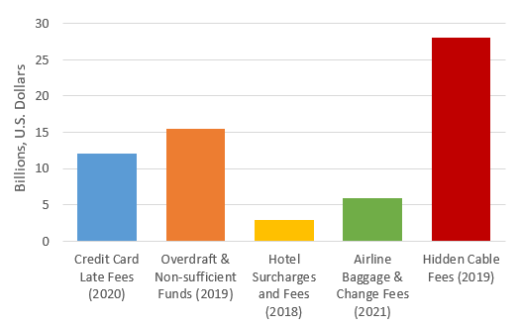

Have you ever noticed being charged additional fees at the end of a buying process? Most individuals would say they haven’t noticed anything or that they resign themselves to paying these additional fees. These surcharges are known as junk fees and can be described as hidden or unexpected charges that are typically not included in the initial price of a transaction but are rather tacked on at the time the payment is made or even after. These junk fees are a source of revenue in many industries, including transportation, banking, internet, hospitality, music, and more. To put this in perspective, the following statistics show how much these surcharges add up:

- The Consumer Financial Protection Bureau (CFPB) issued a report showing that credit card issuers charged $12 billion in late fees in 2020.

- The CFPB also reported $15.47 billion in overdraft and non-sufficient funds (NSF) revenue in 2019.

- Total fees and surcharges collected by U.S. hotels reached a record level of $2.93 billion in 2018.

- The Bureau of Transportation Statistics reported $5.97 billion in airline baggage and change fees in 2021.

- Hidden cable fees were reported to be 28 billion in 2019.

As these statistics reveal, fees account for tens of billions of dollars in revenue in many industries, which hurts market competition and results in consumers having to pay more in costs.

On the bright side, President Biden announced at his State of the Union Address that “[Fees] add up to hundreds of dollars a month. They make it harder for you to pay for bills or afford that family trip. I know how unfair it feels when a company overcharges you and gets away with it. Not anymore. We have written a bill to stop it all. It’s called the Junk Fee Prevention Act.” Biden called on Congress to pass the Junk Fee Prevention Act, which would reduce excessive fees and unexpected charges.

The Junk Fee Prevention Act and the government’s main focus is to implement the following changes:

- Cut off hidden resort and destination fees.

- Ban airline fees that are associated with family members sitting with their younger children.

- Remove excessive, entertainment ticket fees which are most likely seen when purchasing online tickets for concerts, sporting events, etc.

- Eliminate early termination fees for TV, phone, and internet services.

For consumers, these changes mean that they will be able to save thousands of dollars a year by eliminating surcharges being tacked onto their purchases unknowingly. Some countries have already taken steps to require companies to disclose all fees upfront and to prevent companies from charging excessive fees. The Consumer Financial Protection Bureau aims to lower penalties for late credit card payments, setting a goal to reduce fees to as little as $8 when they are currently as high as $41 for a single missed payment. The CFPB announced that they are planning on putting such an adjustment into effect by next year, after receiving public feedback on the measure. Apart from that, the Department of Transportation proposed their actions on airline tickets, requiring airlines to disclose all fees up front. Many more actions will come into play to help reduce excessive fees and unexpected charges in other industries, saving consumers hundreds of dollars a month.

The concealment and accumulation of these Junk Fees are comparable to spending “leaks”, which is an important concept that counselors at Powercat Financial cover to help give students a better idea of small spending habits that can really affect them in the long run. Adjusting your spending habits can help you cut back on these little amounts that initially appear to be little but add up to be much more over time. The accumulation of junk fees can also make it difficult for consumers to budget effectively. If a consumer is not aware of all the fees associated with a particular purchase, they may not be able to accurately plan for the total cost. This can be particularly challenging for low-income consumers who may be working with limited resources and tight budgets. It is important for consumers to be educated and aware of the types of fees that they may encounter when purchasing goods or services.

Please stop by Powercat Financial on the third floor of the student union, and we can help get you started on creating your budget to allow you to achieve your financial goals and to receive help on identifying any of these small amounts that add up over time. If you have questions regarding further financial topics, Powercat Financial is here to help. We offer free and confidential appointments in-person and via zoom over student loans, repayment options, budgeting, saving, credit and debt management, and more. Appointment requests can be made online at www.ksu.edu/powercatfinancial!

Quinton Vlach

Peer Counselor I

Powercat Financial

www.k-state.edu/powercatfinancial