Are you a graduating college and worried about student loan repayment? With midterms, finals week, and projects all wrapping up and coming to an end, the last thing we want to think about is student loans, but with a little planning, they are nothing to be concerned about! We will discuss the process of paying back student loans and how to insure the process is a breeze!

Are you a graduating college and worried about student loan repayment? With midterms, finals week, and projects all wrapping up and coming to an end, the last thing we want to think about is student loans, but with a little planning, they are nothing to be concerned about! We will discuss the process of paying back student loans and how to insure the process is a breeze!

Step 1: Figure out who your student loan servicer is:

Many times, people think that student loans are paid back to their university or the government directly. This is NOT the case. While you are borrowing the money from the government, they have loan servicers who handle the repayment of student loans. If you do not know who your servicer is, the first step is to log in to the federal student aid website (WWW. Studentaid.ed.gov). After logging in, you will find all of your student loans listed, with information such as loan balance, interest rate, loan servicer, and type of loan. After reviewing your loans and finding your loan servicer (CornerStone, FedLoan Servicing, Granite State, Great Lakes Educational Loan Services Inc, HESC/Edfinancial, MOHELA, Navient, Nelnet, OSLA Servicing) you can log in to their personal website and create an account!

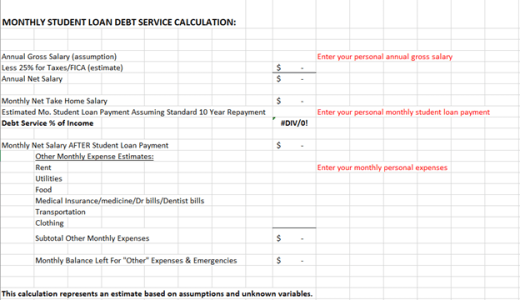

Step 2: How much will you pay each month:

Student loans are paid back on a monthly basis. There are many different repayment plans that are listed below in the next section, but before you pick a repayment plan, it is good to figure out how large of a payment you can financially handle each month. There are many different student loan repayment calculators online but the easiest to use is the Federal Student Aid calculator. You can find it at www.studentaid.ed.gov. This calculator automatically loads your student loan information into the calculator and offers a table of monthly repayment estimates for each specific loan repayment option. With this, you can get a good idea of which monthly repayment plan will work best with your financial budget.

Step 3: Student Loan repayment options:

Once you have created an account on your servicers website, it is time to decide how to take on student loans repayment. The great thing about student loans is that you have a 6-month grace period before you have to begin repayment, with most loans. If you have not used any of your grace period, you do not have to start repayment on the loans for six months. *With unsubsidized loans, we recommend that borrowers begin repayment on the accruing interest before the sixth month grace period ends. Once the grace period ends, any interest that has accrued on your loans will be tacked onto your loan balance, which will cause you to pay interest on top of that accruing interest.* There are many different repayment plans that are offered when paying back student loans. The standard repayment plan is equal monthly payments for ten years (120 months). If your loan balance is above $30,000 and you are worried that monthly payment will be too high, you can apply for extended repayments, which divide the loan up into equal monthly payments over 12-30 years. There are also income based repayment plans. These are for borrowers who believe that they will not make as much money in their first few years working, but by the end of repayment will have a higher income. With this plan, you will pay a lower monthly payment in the beginning, but periodically through repayment, your monthly payment will increase. Another option available is Income-driven plans. Under this plan there are a few different options that take a percentage of your income and formulates a payment based off of the information provided. If you do not specify, you will be put on a standard repayment plan and will need to contact your loan servicer to be put on a different repayment plan.

Step 4: How to save money with loan repayment:

There are a few different tips and tricks that you can utilize to save money with student loan repayment. The first step is to enroll in an automatic payment plan. Loan servicers offer a .25% interest rate discount to customers who enroll in an autopay program. This will also insure that you do not miss a payment, which could hurt your credit score.

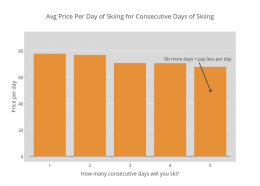

Another way to save money is to be proactive with the loan repayment process. When you make the monthly payment, specify that you would like the put the payment towards the loan with the highest interest rates. Paying down loans with the highest interest rates first, will insure that over time, you are paying the lowest amount of interest possible on your student loans.

There are also ways to get a portion of your student forgiven. If you are planning on working in a public service sector, you are eligible for some type of loan forgiveness. The Public Service Loan Forgiveness is for anyone who works in the public sector (nonprofit, government, state job), and makes 120 qualifying payments. These payments do not have to be consecutive to qualify. If you are a teacher and new borrower, there is a Teacher Loan Forgiveness plan as well. Under this plan, you must have taught full time at a low income school for five consecutive years. Under this plan, you are eligible to have up to $17,500 of your student loan balance forgiven.

To be eligible for these forgiveness programs, you are required to make the minimum required monthly payment until you meet the time requirement.

There are also rural opportunity zones within Kansas that allow for student loan forgiveness. To be eligible, you must live in a rural Kansas County and hold at least an associate’s degree. Under this plan, up to $15,000 can be forgiven (20% of loan balance each year up to $3,000, for 5 years). For more info on this, visit www.kansascomerce.com/rural

Step 5: Don’t Stress

Armed with these tips, you are ready to take on the task of repaying student loans. With proper planning, student loan repayment can be easy and stress free. If you have any more questions regarding student loan repayment, or any other topics, please feel free to schedule an appointment with Powercat Financial. Either I, or another counselor would be happy to assist you!

Preston Tucker – Peer Counselor I