Seniors, are you starting to feel a sense of financial stress or uncertainty when it comes to the cost of living in the new area you are moving to? This stress can occur from moving from an apartment to a house, transportation costs in a new area, or maybe even the cost of groceries in that area. These factors can be calculated and budgeted out to ensure that the financial stress and uncertainty you may experience can be minimized if not eliminated with two simple steps!

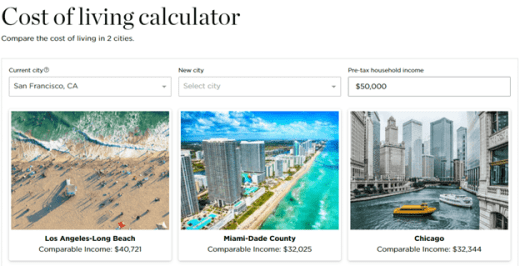

Step 1: Start by using a cost of living calculators such as Nerd Wallet’s cost of living calculator or Bankrate’s cost of living comparison calculator to estimate the cost of living in that certain geographic area. This could be especially useful to use when graduating from college and moving to a new city or when you are looking at job offers and want to know if it would be an acceptable offer based on the cost of living in that area.

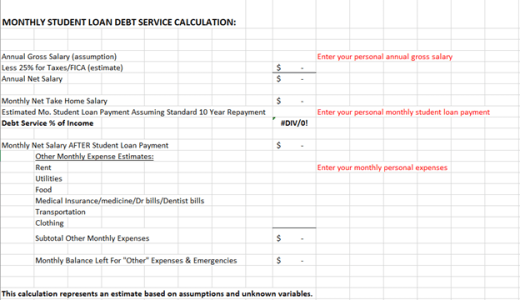

Step 2: Once you have utilized a cost-of-living calculator to get that estimated amount that you will need to make to maintain your lifestyle in your new city, BUDGET & PLAN! Your next step requires you to take a step back and create a budget or tweak your existing budget to account for the changes in different categories based on the price. Creating a budget for this change can lead to lower stress levels when it comes time to move because you will have a plan in place. Budgeting also requires you to create a habit by being disciplined and holding yourself accountable to this budget.

Below are three cities and current common expenses taken from the NerdWallet Cost-of-Living Calculator.

Manhattan, KS

- 2-bedroom apartment: $944

- Gallon of Milk: $2.11

- Gallon of Gas: $3.30

- Movie ticket: $13.75

- Cost of a doctor visit: $135.63

Phoenix, AR

- 1-bedroom apartment: $1,996

- Gallon of Milk: $1.93

- Gallon of Gas: $3.82

- Movie ticket: $9.87

- Cost of a doctor visit: $99

Baltimore, MD

- 1-bedroom apartment: $1,823

- Gallon of Milk: $2.41

- Gallon of Gas: $3.30

- Movie ticket: $13.41

- Cost of a doctor visit: $83.42

Looking at these three locations and the different costs associated with each, we see that a budget can help you understand and anticipate expenses so that you know what lifestyle to expect. Don’t just look at one big expense, like housing, breakdown the overall expenses associated with living in your new location to have an effective plan. Little costs (or savings) add up.

Remember – no matter the circumstance, it is never too late to create a financial plan to set yourself up for success!

Don’t hesitate to stop by Powercat Financial to get help starting this budget now! Powercat Financial is here to help assist with any financial topic and concern you may have! We offer free and confidential peer-to-peer counseling sessions in person or via Zoom at your convenience. Not only can we talk about budgeting, but we can go over other topics such as student loans, credit, or savings as well. Appointments can be made online.

Halle Schindler

Peer Counselor I

Powercat Financial

www.k-state.edu/powercatfinancial