When searching for a job, it’s easy to get caught up in the salary amount and forget about employee benefits. The prevalence of benefits in job offers has increased over time and now makes up around 30% of your overall compensation package. While there are many different examples of employee benefits, today, we will discuss a few common examples and some things to keep in mind:

Monetary Benefits

Monetary benefits provide the employee with direct financial compensation. These items will have a direct impact on an employee’s take-home pay. Examples include:

- Salary or Hourly Wage

A salary is a fixed amount that employees earn annually regardless of the number of hours worked. Salaried workers are typically paid biweekly or monthly and receive the same amount each paycheck. An hourly wage means that employees are paid per hour worked and are eligible to receive overtime pay for working more than 40 hours a week. It is important to note that overtime hours are not always guaranteed and usually depend on the needs of the company. - Signing Bonus

A one-time payment offered to incentivize new hires to join the company. - Yearly Increases/Bonuses

Annual raises and bonuses are awarded once a year to recognize performance, long-term loyalty to the company, and cost of living adjustments. Yearly increases are typically seen every year you are with the company, whereas bonuses are not guaranteed and typically based on your performance during that year. - Profit Sharing

A company shares a portion of its profits with its employees. Financial compensation is based upon the performance of the company. This approach motivates employees to work harder since their earnings are directly tied to the company’s success. - Stock Options

Stock options give an employee the right to buy company shares at a predetermined price. Employees will benefit as the company’s stock value increases over time.

Near-Monetary Benefits

Near- Monetary benefits are indirect financial perks. While they do not show up as cash on your paycheck, they can help you save money or remove items from your monthly budget. Here are some examples:

- Health Insurance

Employers typically offer group health insurance plans that are more affordable than an individual plan. Health insurance helps to cover out-of-pocket medical expenses such as doctors’ visits, hospital stays, procedures, and prescriptions. By paying a monthly premium, employees gain access to a range of healthcare services at a lower cost, often with a portion of the premium covered by the employer. - Retirement Contributions

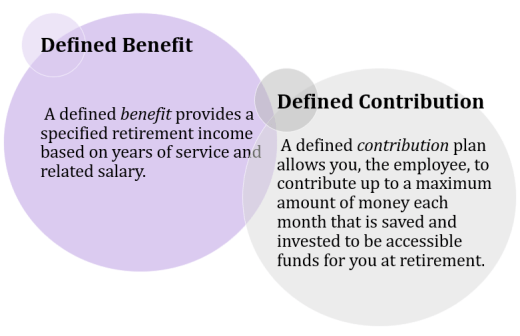

Many employers offer retirement savings plans such as a 401(k) and match a portion of the employee’s contributions. This is essentially free money helping you to build your retirement savings faster. These contributions are typically deducted from your paycheck. Companies use a vesting schedule to determine when an employee gains full ownership of employer contributions, typically between three to six years. If you leave the company before the end of vesting, you will only be entitled to a portion of the employer’s contributions but will still receive all the contributions you, as the employee, have contributed. Below is an example of a vesting schedule.

- Paid Time Off

Paid time off allows employees to take time away from work while still receiving their regular pay. Some companies separate the days into vacation and sick days while others combine them into a single PTO bank. Employers may offer PTO as a set number of days, accrued over time, or unlimited. If your company uses unlimited PTO, I encourage you to ask questions such as the average number of days taken per year and the approval process for time off requests. - Tuition Reimbursement

Employers may offer tuition reimbursement to encourage employees to continue their education. The company will typically cover part of or all the costs for job related courses or degree programs. There may be specific requirements such as maintaining a certain GPA or staying with the company for a set period after completing their education.

Other examples include complimentary childcare, a company car, travel awards, relocation assistance, training and education, and optical or dental insurance.

Non-Monetary Benefits

Non-monetary benefits are perks that enhance an employee’s well-being, job satisfaction, and work-life balance without directly providing monetary compensation. Some examples include:

- Flexible Work Arrangements

Employers may offer flexible work arrangements such as remote work and flexible hours. While these do not cost the company anything, they can help to improve the employees’ stress levels and work-life balance. Some companies have even begun to offer working 4/10s, four days a week with ten hours each day. - Job Title

A job title that accurately reflects all your responsibilities can be valuable. Having a prestigious title can help build your professional reputation and make it easier to qualify for job opportunities in the future. - Home Equipment Usage

Home equipment usage refers to an employer providing remote workers with essential equipment such as laptops or monitors. If you plan to work hybrid, it can be useful to have a separate laptop in the office and at home to minimize the load you are carrying into work each day.

A competitive salary is an important part of your offer, but a strong benefits package can improve your overall happiness and stability at a job. Before accepting a job offer, take the time to review what’s included and compare it to your priorities and long-term goals. Powercat Financial counselors would be more than happy to review an offer alongside you if you feel overwhelmed. Lastly, don’t forget that many benefits, such as PTO, flexible scheduling, and retirement contributions, have the potential to be negotiable. Advocating for your needs can lead to an offer that truly fits your lifestyle. If you are interested in learning more about this topic, schedule an appointment via Navigate to meet with a Powercat Financial peer counselor.

Avery Williams

Peer Counselor I

Powercat Financial

www.k-state.edu/powercatfinancial