Employee Benefits are any kind of tangible or intangible compensation given to employees apart from base wages or base salaries. Two of the foundational benefits are health and wellness benefits and retirement benefits.

What are possible health and wellness benefits?

Health and wellness benefits include healthcare insurance, dental insurance, vision insurance, life insurance, disability insurance, prescription drug coverage, employee assistance programs, and wellness programs.

What definitions do you need to understand my benefits?

Premium: The monthly cost of an insurance plan is called its premium. This cost is often partially paid by the employer with the remaining cost falling on you, the employee.

Deductible: When an insurance claim/incident (typically medical) occurs, the deductible is the amount you have to pay out-of-pocket first before your insurance starts paying your claims.

Copay: A copayment is a fixed cost attached to specific services for your healthcare. When you pay a co-pay for your service, the remaining cost will either be covered by your health insurance or split between you and the healthcare based on the co-insurance amount. An example of a copay would be a $40 flat charge for every general care appointment from your Primary Care Physician.

Coinsurance: Co-Insurance is a percentage attached to medical costs that identifies how much you pay of the medical expenses after your deductible has been paid.

Example: You have a 20/80 coinsurance indicating 20% is your cost. If you have $100 in expenses and your deductible has been paid, you will owe $20 (20% of $100). It is important to note that some plans may list the same benefit as 80/20 (reversing the numbers), so it is always important to identify which portion you are responsible for.

Out-of-Pocket Maximum: Your out-of-pocket maximum on your health insurance policy is the maximum amount of money that you will have to pay in total for the year, excluding premiums and balance bill charges.

Example: Imagine you have a $1,000 deductible, 20/80 co-insurance, an out-of-pocket maximum of $10,000 and a large medical expense of $50,000. In this example you would pay $1,000 deductible first [50,000-1,000=49,000], then 20% of the remaining costs up to 10,000 maximum [49,000*.2=9,800], but because you already paid $1,000 of your $10,000 maximum you only have to pay [10,000-1,000=9,000] 9,000 of the remaining $9,800 expenses.

Network: Your healthcare network includes all the facilities, providers, and suppliers your health insurer has contracted with to provide health care. Most plan will still cover out-of-network health care, but they will cover a smaller portion, so your expenses will be much higher.

Primary Care Physician: Your primary care physician will be your go-to for general care and your source for referrals to additional medical care. When reviewing your benefits, your primary care physical will often be referred to as your PCP.

What are possible retirement employee benefits?

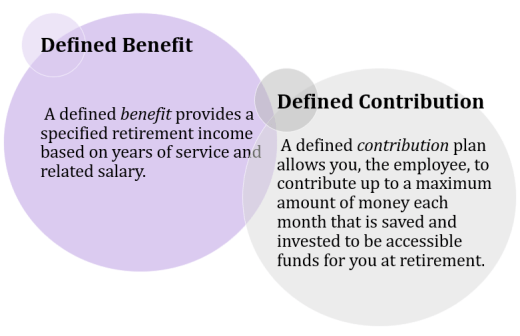

There are two basic categories of retirement plans:

- Defined Benefit Plans: A defined benefit provides a specified retirement income based on years of service and related salary.

- Defined Contribution Plans: A defined contribution plan allows you, the employee, to contribute up to a maximum amount of money each month that is saved and invested to be accessible funds for you at retirement.

Various types of retirement plans exist based on the type of employer you have, but all the defined contribution plans work similarly. The defined contribution plan options will either be a 401(k), 403(b), or a 457. A pension plan is a defined benefit retirement plan.

- 401(K) Retirement Plan: Define contribution plan used by for-profit organizations

- 403(b) Retirement Plan: Defined contribution plan used by tax-exempt organization (e.g. public schools, churches)

- 457 Retirement Plan: Defined contribution plan used by nonprofit and government organizations

- Pension Retirement Plan: Defined benefit plan. Social Security is a defined as a pension plan.

What is a % contribution match on my defined contribution retirement plan?

An employer-sponsored match on your defined contribution (e.g. 401(k)) retirement plan means that your employer will equally contribute the same amount of money that you contribute, up to a certain percentage of your income, often between 3-5%.

For example, let’s say Tristan makes $40,000 a year and Tristan’s employer provides a 4% match. If Tristan chooses to save 8% of their income, [$40,000*8% = $3,200] then their employer will also contribute up to 4% to Tristan’s retirement plan. Since Tristan chose to saved 8% then the employer will contribute the full match of 4% [$40,000*4% = $1,600].

How can Powercat Financial help you with employer benefits?

Powercat Financial is a free, confidential peer financial counseling service for K-State students. At Powercat Financial, we work together with students to explore and discuss topics like credit, student loan repayment, budgeting, and job offerings. Employee benefits are a major factor to any job offer as well as your financial well-being and as such it is important to understand what you’re being offered and how to benefit from these employer-sponsored benefits. I’d encourage K-State students looking to review a job offer and benefit package to schedule a free appointment to have one of our counselors guide you through your employee benefits!

Chet Redstone

Peer Counselor I

Powercat Financial

www.k-state.edu/powercatfinancial