Considering saving for retirement as a college student may seem crazy, but it could benefit you more than you may realize! Below are some common questions and answers regarding retirement planning. Even if you do not have the financial capacity to begin saving now, it is a great topic to be educated on as you move through your adult life. Saving as soon as you are in a comfortable financial situation and are earning a steady income is something your future self will thank you for!

1. Is there a process I should follow?

a. Before investing, establish an emergency fund.

i. An adequate emergency fund is equivalent to 3-6 months of living expenses. This money would be set aside for emergencies such as a car accident, an event that will force you to miss work as an hourly employee, a health emergency, etc.

b. Next, pay off debts.

i. Some believe you should pay off all debts before saving for retirement.

ii. Some believe you should feel comfortable with your debts, then save.

iii. Below is a resource that goes in depth on what should be prioritized: https://www.debt.org/retirement/prioritize-savings-vs-payoff/

c. After paying off debts, begin investing in your future.

2. When should I start?

a. The earlier the better

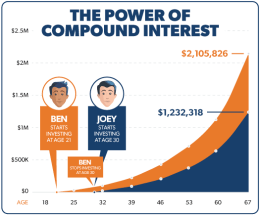

i. Compounding interest is a very powerful with time on your side. Compounding interest is interest that accumulates not only from your initial principal amount, but also from the interest earned on that principle in previous periods.

ii. Below is a link to a resource that includes a visual representation of the power of compounding interest.

https://www.ramseysolutions.com/retirement/how-does-compound-interest-work

As you can see, Ben started investing at age 21, but only contributed for ten years. Joey, on the other hand, started investing at age 30 and invested the same yearly amount as Ben, but for 37 total years (27 years more than Ben!) Due to the difference in timing, Ben’s retirement fund grew to almost double what Joey’s did, even though he initially invested $67,200 less than the amount that Joey contributed.

3. Retirement is such a complex topic; how should I know what kind of account to invest in?

a. Pensions

A pension is a retirement program where an employer makes contributions and controls investments, so that when an eligible employee retires, they receive a fixed payout. This is different from other plans because the employee never actually contributes money. The employee just receives income after they retire if they have worked for the company for a specified period.

b. 401(k) / 403(b)

More commonly, these are employer sponsored plans that employees contribute to and generally control what their account is invested in. A 401(k) is typical for most companies, but a 403(b) is for teachers employed by a public school. There are yearly limits for how much money can be contributed by an employee, but these amounts change yearly. There are also employer match programs where an employee contributes a percentage of their salary, and their employer matches that, or contributes the same amount. This is beneficial because it is practically free money! A 401(k) can be either Roth or Traditional, which I will discuss more below.

c. Roth IRA / Traditional IRA

Finally, there are Individual Retirement Accounts (IRA’s). An IRA can be either Traditional or Roth, which has to do with tax treatment. The difference between an IRA and a 401(k) is that an IRA is not employer sponsored. You typically open IRAs through a bank or financial institution. Traditional means that money goes into the account pre-tax, meaning you pay taxes on it at the time it is withdrawn. This type of account grows tax deferred. On the other hand, Roth IRA contributions are after-tax meaning you pay tax on it when contributed rather than when withdrawn. This account grows tax-free. IRAs also have yearly contribution limits, similar to a 401(k).

Note: Although there are limits on how much can be contributed to retirement accounts like IRAs and 401(k)s, there are options to have more than one type of retirement account.

4. Once I have established my emergency fund and feel comfortable with my debt, how much money should I be contributing to my retirement account(s)?

a. This question really depends on each person’s personal situation. For a college student taking out student loans, making it through college and reducing loan debt might be the first goal. For a college student with no loans and steady income, there might be a certain amount of each paycheck that could be contributed- but that amount would depend on the income and living expenses. For a full-time employee of a corporation, it might be a certain percentage of their salary depending on their employer’s match program. In conclusion, the specific amount or percentage, as well as what type of account to invest in, depends solely on the circumstances. Connect with an investment advisor to find the right plan for you.

If you would like to learn more about this topic, schedule a free and confidential appointment with Powercat Financial through your Navigate student portal under Financial Services.

Katelyn Silcox

Peer Counselor I

Powercat Financial

www.k-state.edu/powercatfinancial