If you ever think about traveling, you know that the cost can be extreme, especially for inexperienced travelers. Over half of Americans avoid traveling because of the cost alone, much of which can be avoidable. This is unfortunate because many people want to visit other countries or states but because of that looming cost, many people do not have the available funds to experience travel. The overarching budget busters are things like immediate convenience, not planning or researching your trip, and lack of knowledge about where to go. Here are some great tips to cut down on traveling costs to make that dream trip affordable.

Where to travel? Some of the biggest cost savings available for travelers is picking out the right place to travel to. Many of the largest tourist attractions of the world, like Rome or Paris, can be extremely expensive at first glance. Although some of these costs are unavoidable, there are many costs that can be cut back to make it significantly more affordable. First off, unless you are looking to go to somewhere specific, there are a lot of great options that won’t shred a hole through your bank account. Want a nice tropical island vacation? Maybe your first thought is Hawaii, but that can be extremely expensive. Consider better budget alternatives like the Bahamas or Puerto Rico where you can double your vacation time or cut your costs in half!

Another great option for someone with no particular location in mind is to use Google Flights! You can use the map or explore functions to look around at locations to find cheap flights. Additionally, use the Google Flights calendar function if you have some flexibility to find which day of the week or week of the month flights are the cheapest. Days like Friday and Saturday usually have some of the highest costs, so if possible, book a flight to leave on Tuesday or Wednesday to avoid the higher cost.

Still stuck on going to that one dream city? You can always fly into a less popular city or airport and use various modes of transportation like bus, train, or boat to go from where you land to where you want to be. For example, if you wanted to go to Montevideo, the capital of Uruguay, you’ll find the flights are quite expensive. On the other hand, you could fly into Buenos Aires, Argentina for several hundred dollars less, and use the twice daily ferry going between the two cities for less than $50. This could equate to hundreds in cost savings if you are willing to spend a little more time traveling with the added bonus of being able to see somewhere you might not have originally intended.

Travel during the off season. Most locations have a heavy tourist season with jacked up prices and an off season where the price of everything comes down. Think of March with spring break, where the demand is much higher so the prices will sometimes double. Additionally, go somewhere where the US dollar is worth more. Many hotspots in Europe, like France, England, or Switzerland, have their native currencies worth similar amounts or more than the US dollar. These places can rack up high costs very quickly. Compare that to somewhere like Mexico where the peso is worth much less than the US dollar. Usually everything from hotels to services are much cheaper, where one dollar in Europe could buy a bottle of water compared to one dollar in Mexico which could yield you multiple times more value. The Price of Travel website has some great price comparisons and indexes to find places where the US dollar has more value.

Transportation is usually among one of the highest concerns when planning the cost of a trip. With rental car places charging exorbitant amounts of money for just a few days, this is easily one of the highest costs to cut. Depending on where you travel, most urban centers or countries have a high level of public transport for free or at minimal costs. Whether it’s a 7 day unlimited train pass in New York City for around $30 or a discount card saving over 50% of normal costs of public transportation in London, public transportation can be far more affordable than a typical rented car.

Bus lines and trains outside of city centers can also be an extremely cost effective method of travel. With flights being as expensive as they are, a flight from one side of a European country to the other could cost a lot. Bus lines and trains can be a much cheaper way of traveling, although it does take more time. Most countries in the world have either train or bus lines set up to go from city to city and could potentially save you hundreds on airlines or taxis.

In places where public transportation is less developed, there are usually some great options that tourists can buy for cheap. For example, in Vietnam, you will see tourists and locals alike zooming around on mopeds and motorbikes and some taking cross country trips on them. Another cheap option to avoid Taxi or Uber costs are scooters. Many cities now have scooters that will only costs a few bucks for a couple mile trip. If you are not quite so comfortable with something like that, there are still some great options to cut costs. Using a service like Uber over the local taxi system can sometimes be preferred depending on location. Usually taxi drivers are able to scam or charge the infamous “foreigner tax” to make a $5 taxi ride for the locals suddenly $15 for a traveler. Uber avoids most of this, although they do still use their dynamic pricing model which increases costs during high traffic times, but since Uber is cashless, the issue of exchange rate confusion can also be avoided.

If there are no other means of transportation and you must rent a car, there are still some good alternatives. Services like Turo that use car sharing can allow you to rent cars at much cheaper rates than the standard airport car rental. If you aren’t comfortable with using a service like that, try going away from the rental car facility tied to the airport. Convenience is an upcharge for them, so if you are able to leave the airport in an Uber and stop at a different car rental closer to your first destination, you can usually get much better rates.

Phone service is one of the most overlooked costs when planning a trip. People tend not to think about the fact that their service plan likely does not work in some areas of the world and end up a victim to the carrier fees that end up imposed on top of your current plan (some over $10 per day). One easy way to avoid this if you have an unlocked phone, meaning your SIM card is changeable, you can buy prepaid sim cards that last the length of your trip or load money onto a SIM card as you use it, with many of these options being $30 or cheaper. Additionally, you can always put your phone on Wi-Fi only mode and you won’t have to worry about any extra charges.

Food tends to be another budget breaker for many travelers with convenience and experience being some of the largest upcharges. Many popular tourist cities have shops and restaurants around popular landmarks that price gouge customers. These are usually easily identifiable with much of their menu being translated into many different languages or prices not being easily apparent. Avoid these places and eat somewhere local, think of the places the natives eat. On your first day somewhere, stop by a supermarket or local grocery store and pick up some snacks and drinks. Travelers will pay an upcharge for a water on a hot day at a tourist spot resulting in multiple dollars for one bottle when they could buy a 12 pack for multiple times cheaper at a market with better planning. Pack some snacks and fill your water bottle at the airport before you leave so you can avoid those outrageous airport prices.

Monuments and attractions are obviously some of the biggest reasons to visit somewhere. Some of these places do have standard fees to see or visit that you can’t avoid. On the other hand, the secondary attractions you decide to go to last minute or are less important can easily increase the cost of your trip. Most places will have a multitude of free or cheap options that could easily fill your schedule or substitute for another, more expensive option. Spend some time researching and constructing a list ahead of your travel so you have some options to choose from based on what you feel like doing.

Where to stay? Hotels are often quite expensive if you do not spend much time researching other options. One option many travelers opt into are hostels. If you are not familiar, they are much like a dorm with options to have a private room for a premium or a shared room with other travelers. On average, hostels can multiple times cheaper than hotels with some, depending on location, being less than $10 a night. If you aren’t comfortable with an option like that and prefer a hotel room, make sure you shop around on Google for good alternatives to tourist hotels for something a little bit further away from the city center to cut down on costs.

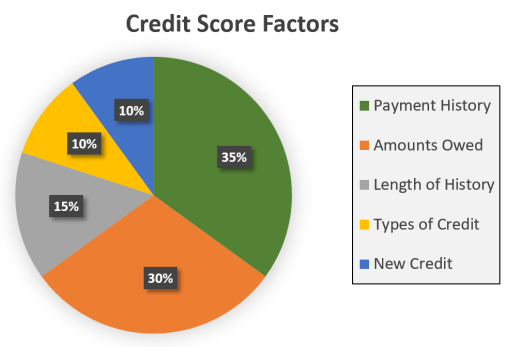

A credit card can be a traveler’s best friend. Many credit cards have great travel benefits with miles and points that can save you thousands of dollars a year. Some debit and credit cards have high foreign transaction fees to look out for, where as some credit cards have zero or very low fees that can save you money when visiting a foreign nation. Additionally, credit cards have an extra layer of protection that debit cards to not provide when traveling that can be useful in places with lots of scams or when buying something from a sketchy shop. Try to avoid ATM fees as much as possible because they can be extremely misleading and a borderline scam themselves. Additionally, some foreign nations have higher transaction rates on the streets than they do at official exchanges. For example, in Argentina, there is a full street/plaza with vendors offering exchange rates that can exceed official exchange rates. Obviously, when choosing a riskier option like this, be on full lookout for scams and proceed with maximum caution as foreign travelers are usually the least knowledgeable person on the street.

Overall, there are a lot of ways to cut back on costs to either make a trip more affordable or to extend a vacation. Most of these savings depend on your comfort level with the available options, but always ensure you do your research about something before avoiding it. Planning your trip effectively, researching alternatives, talking with locals, tracking spending, and overall being smart about the situation you are in are key factors in deciding the amount of cost savings you are able to achieve.

If you have questions regarding travel budgets or credit cards or any financial topic, Powercat Financial is here to help. We offer free and confidential appointments in-person and via zoom. Appointment requests can be made online at www.ksu.edu/powercatfinancial or the direct link here!

Brenton Wilden

Peer Counselor I

Powercat Financial

www.k-state.edu/powercatfinancial

Durable Power of Attorney

Durable Power of Attorney