Achieving financial success doesn’t require large changes. Sometimes, it’s the small consistent habits that make the larger impacts down the road. These are what we considered in the financial industry to be micro-habits. These tiny, everyday actions can have massive financial impacts over time. Whether it’s tracking your spending, automating savings, or cutting back on small expenses, these habits can build up over time to create a solid foundation for improving financial health. By incorporating micro-habits into your daily life, you can set yourself on a path towards a healthier financial life.

Track your spending daily.

• Micro habit: Spend 5 or less minutes every day reviewing your expenses.

• Why it works: Tracking your spending regularly helps you stay aware of where your money is going. It also helps prevent overspending. Ways you can go about tracking your daily spending include manually checking your credit card and debit card accounts or downloading apps like NerdWallet or PocketGuard.

• Benefit: By regularly staying on top of your spending, it prevents you from overspending or being unaware of your expenses. It also creates a level of safety in knowing if your information has been stolen by immediately being able to recognize a purchase that wasn’t from you.

Set aside income for savings.

• Micro habit: Every time you get paid, set aside a percentage of your income for savings.

• Why it works: Small amounts of savings add up over time. Doing this consistently overtime helps build up an emergency fund and ensures that you’re building your wealth passively.

• Benefit: By regularly contributing small amounts over time this allows you to create a nest egg of funds in the emergency that you need a chunk of cash. It also creates a mindset of saving that can translate further down the road for when it comes to retirement and other savings goals.

Pay off credit cards in full monthly.

• Micro habit: Each month pay off your credit card in full before the due date.

• Why it works: Paying it off in full each month allows you to avoid paying on hefty interest rates, fees, and debt payments.

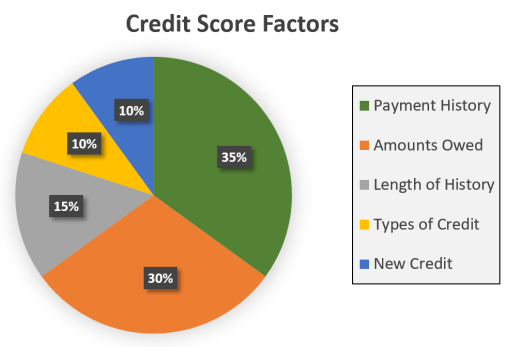

• Benefit: By paying your credit card off in full every month, you avoid spiraling into credit card debt, paying extra fees, and it helps build your credit score. Think of this as three birds, one stone kind of benefit when paying your credit card off in full.

In summary, micro-habits are small actions that, when practiced regularly, can lead to significant improvements in financial health. By focusing on simple behaviors like tracking spending, saving regularly, and paying off credit cards in full, you can start building better financial habits. These small adjustments to your daily life can have large impacts on your financial health over time. With patience and consistency, micro habits can lay the groundwork for lasting financial success. If you have any further questions or would like to learn more about this topic, reach out to us at Powercat Financial Here to schedule an appointment.

Drew Cason

Peer Counselor II

Powercat Financial

www.k-state.edu/powercatfinancial