Category: Floods

Spring is a great time to review insurance coverages

Information to help protect your home and financial well-being. Timely information about insurance coverages from K-State Research and Extension written by Connor Orrock and Katie Allen was first published March 28, 2016.

Insurance is important to safeguard against the unimaginable. However, it is easy to get overwhelmed with the insurance process given all of the add-ons and options available.

The recent wildfires in south-central Kansas call to mind the importance of having insurance to protect your home and other buildings. The recent increase in seismic activity in Kansas and Oklahoma, as shown by the Central United States Earthquake Consortium, may have you wondering if it is time to look into getting earthquake insurance, particularly if you live in a zone that might experience an earthquake.

“It is important to be familiar with the details of all your insurance policies, so that you know what you are covered for,” said Elizabeth Kiss, associate professor in the School of Family Studies and Human Services at Kansas State University. “In regard to policies that cover wildfires, floods or earthquakes, you have to know what triggers them and when you can file a claim.”

Policyholders should be familiar with the perils covered, which are the causes of the loss. Some common perils on a policy are fire and theft, as examples. Typically flood, earthquake, war and nuclear accidents are general exclusions from a homeowner’s insurance policy, Kiss said, but they may be added separately.

Kiss, a family resource management specialist for K-State Research and Extension, said the fastest way to see if you have earthquake insurance or to change your policy to get earthquake insurance would be to contact your insurance agent. As with any insurance policy, you should purchase earthquake insurance from a reputable insurance agent.

Guidelines for flood insurance coverage are contained in the National Flood Insurance Program. Homeowners, renters and businesses are eligible if their community participates in the NFIP. The average flood insurance policy costs about $700 per year, Kiss said.

“Many places that experience flooding are not actually in areas where you are eligible,” she said. “While the program is subsidized, it is still relatively expensive.”

Kiss stressed the importance of reviewing your insurance policies at least once a year. It is especially important to review policies before renewing. As the value of possessions changes, it is imperative that you are neither over nor under insured. Your coverage should be up to date.

“Be aware of the fact that there is a difference between what you paid for your house and what it would cost to rebuild,” Kiss said. “To rebuild a house is probably more expensive than what was paid for it if the house is several years old.”

If you want to save money on insurance coverage, she said, there is an inverse relationship between the amount of your deductible and the amount of your premium. A lower deductible means you will more than likely pay a higher premium. You may be eligible for discounts, such as those offered when purchasing multiple lines of insurance from the same agent. Be sure to ask your agent about potential discounts, as well as policy limitations.

Perhaps the most important thing is to be aware of the two forms of coverage – property and liability, Kiss said.

“Your homeowner’s insurance will cover the property and structures such as your home and garage, but maybe not outbuildings unless you have specific coverage (for the outbuildings),” she said. “You’ll also want to know what kind of personal property is covered inside the home and garage.”

Liability coverage is needed in case anyone gets injured on your property or if your property causes injury to someone else, Kiss said. For example, liability coverage would kick in if a tree on your property were to fall and cause damage or injury to the neighbors.

For more information about insurance and how to choose a policy that will work best, Kiss recommends visiting the Insurance Information Institute online. For information about insurance and other items related to family resource management, contact your local extension office.

#SpringSafety

As spring spreads across Kansas it is a good time to review the most likely risks or hazards that you face. Take action by preparing or updating an emergency supply kit and a family communication plan.

The most common spring hazards faced by Kansans include:

- Severe Weather/Tornadoes

- Floods

- Lightning

- Heat

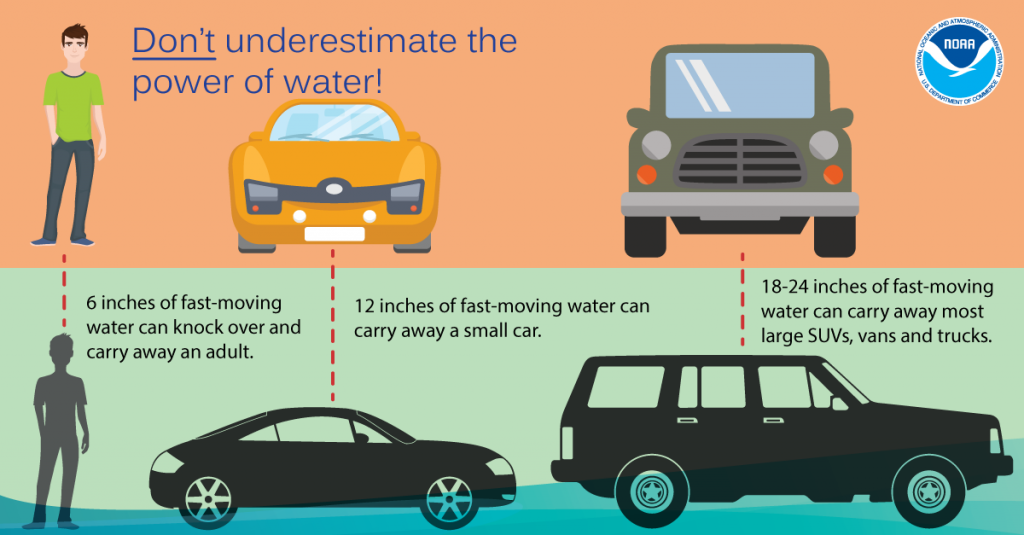

Did you know that flooding is the most common natural disaster in the United States? Learn more.

Grab-and-go bags

One of the Prepare Kansas week 3 challenge tasks is to begin assembling grab-and-go bags for family members, including household pets. You may be wondering how these are different from the emergency supply kits you assembled in weeks 1 and 2.

The short answer is that they may contain some similar items. In our minds, there are differences though. A basic household or vehicle emergency kit will be used whenever there is an emergency. A grab-and-go bag will likely only be used when you and members of your household need to evacuate quickly. Sometimes it might be hard to decide what the outcome of the emergency will be and you will want to grab both.

Items to include in grab-and-go bags for individual family members include those that are listed as additional items to consider on FEMA’s emergency supply list as well as the supplies for unique needs listed at http://www.ready.gov/kit

Individual and family needs vary and so will needs over time. Be sure to include items that will meet your current needs and update your grab-and-go bags at least once a year.